This post marks the end of my summer book review series, which signals a wrapping up of Monday discussions regarding the high cost of college that began earlier in the year.

Not that there isn’t a lot more to say about why the price tag associated with higher education has shot through the stratosphere, or how that price curve is impacting people’s choices of where (or whether) to attend college in the first place. But given that I began this analysis in order to see where emerging alternatives to a traditional (and increasingly unaffordable) college experiences might fit into a changing educational landscape, it seems time to reach a few conclusions (which I’ll do next Monday) and move on.

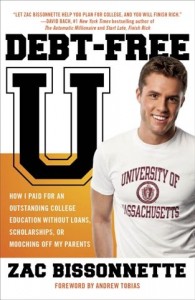

But before then, a look at Zac Bissonnette’s Debt-Free U, a book with the ungainly but descriptive subtitle of “How I Paid for an Outstanding College Education Without Loans, Scholarships, or Mooching Off My Parents.”

Bissonnette wrote the book when he was still an undergraduate at the University of Massachusetts in Amherst, living by the rules he set down for how to get everything you want from college without begging or borrowing (in fact, the author seems to have ended his experience with a positive cash flow).

Those rules boil down to:

- Thinking up-front about what you can afford, not just where you can get accepted

- Avoiding any financial option that involves students or parents taking on debt

- Getting the most out of a college experience by taking it seriously or, as he describes in a chapter of the same name: “How to Make Any College an Ivy League College”

Unlike other college guides I’ve been reading over the summer, which either matter-of-factly outline the application and financial aid process (my favorite being this one from The Princeton Review) or offer self-help advice on how to apply for all that supposedly “low-hanging” private scholarship money that will allow you to go to college “without paying a dime!” (my favorite being none of them since they all stuck me as a crock), Debt-Free U is both insightful and pragmatic.

For instance, that supposedly “low-hanging fruit” (scholarships offered by all kinds of organizations, clubs and professional groups) is great if you can get it, but also represents just 5% of the financial aid available to students (the other 95% coming from federal and state government, or schools themselves). And given Bissonnette’s financial bent (he’s been writing professionally on the subject since High School), his sensible advice is that it’s easier to find money where most of it is located.

But even here, he’s very cautious about any conventional government + school financial aid plan that requires debt financing. For the process of applying for aid (which I’ll detail in the next edition of the Degree of Freedom news – sign up to the right) includes the all-important Expected Family Contribution (or EFC) – a formula-based calculation of how much a family can afford to contribute to a student’s college bill based on their financial particulars.

Putting aside controversy over how an EFC is generated, Bissonnette points out that it is up to a family to determine what it can actually afford, no matter what some government-sponsored calculator tells you. And if an EFC says you have to cough up more money than you have access to (requiring raiding of retirement savings or taking on excessive debt), it’s time to think again about where you kid thinks he or she “deserves” to go to school.

The author harps quite a bit on the ruinous results of student debt, a topic that comes up in almost any discussion of the cost of higher ed. But I particularly enjoyed his highlighting the fact that college is just four years of one’s young life. So, for example, a Kansas kid who’s been dying to leave the farm and live in the city can go into hock to attend NYU for four years (and then move back to his parents’ farm in Kansas for the next decade or two until his loans are paid off), or go to U Kansas for four years and be able to afford to move to NYC after he or she graduates.

As someone who shares the author’s debt-phobia, I agree with the notion that parents (and students) should take a hard look at options before, during and after the application process and try to find some combination of savings, sacrifice, paid work and reality checking that will land junior at a perfectly good school without sacrificing anyone’s financial future.

And I was particularly happy to read someone who eloquently punctures so many myths regarding attending and paying for school, my favorite (i.e., least favorite) being the one that says a college degree is worth any price it since – on average – it adds $1 million to a student’s earning power over their lifetime. That “on average” thing always bothered me since, for lower earners contributing to that average, college is going to be a financial wash (or net negative). But Bissonneette also highlights that this supposed $1 million differential only applies when comparing those who go to college with those who don’t. Beyond that, there is very little data that says the marginal difference between attending a costly private school vs. a cheaper state one makes anywhere near that much difference in one’s lifetime earnings.

Given that someone is most likely to both get into a good school and succeed in life if they are self-motivated, serious learners with a good work ethic and a degree of financial responsibility, it’s not clear if high achievers graduating from an Ivy succeed because of what they got out of four years there or what they brought into the experience. And, as the author points out, large state colleges and even community colleges are full of talented professors eager to teach motivated and dedicated students. And being this type of student is how you can turn any college into an Ivy.

By the end of the book, Bissonnette’s list of suggestions for how to pay your own way through college (move out of the dorms, buy used textbooks, get hired as a golf caddy, sell your blood) reminded me of an attitude shared by many of us thinking and writing about reform in higher education, an attitude best summed up as: “things would be much better if everyone behaved like me or shared my experiences.”

For successful entrepreneurs like Peter Thiel or home school veterans like Dale Stephens, independence and entrepreneurship are more important than institutional learning. And their own lives are proof that this thesis can work (and does work for the <100 people they attract to their programs each year).

Similarly, Bissonnette is arguing that thinking like a financial investor at an early age can pay countless dividends (which it can). My only problem with any of these approaches is that they are likely to only reach a small subset of kids who are already wired for success – although writing a book of common sense wisdom regarding paying for an overpriced investment like higher education stands the chance of influencing enough families that it could make a difference in people’s lives.

Leave a Reply